What You Should Know Before Opening an Offshore Trust

What You Should Know Before Opening an Offshore Trust

Blog Article

Exploring the Key Features of an Offshore Depend On for Wide Range Monitoring

Offshore depends on have actually obtained focus as a tactical tool for riches monitoring. They supply distinct benefits such as possession security, tax obligation optimization, and improved personal privacy. These depends on can be tailored to fulfill certain monetary objectives, guarding assets from prospective threats. Nevertheless, there are very important considerations to keep in mind. Recognizing the details of overseas counts on might disclose greater than just benefits; it might reveal potential obstacles that warrant cautious thought

Understanding Offshore Trusts: A Guide

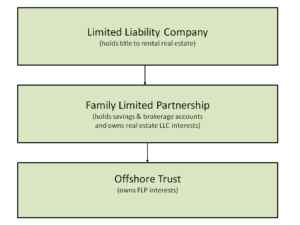

Although overseas trust funds may appear facility, they work as useful monetary tools for individuals looking for to handle and safeguard their wealth. An offshore trust fund is a legal plan where an individual, called the settlor, transfers properties to a trustee in an international jurisdiction. This structure enables enhanced privacy, as the information of the depend on are not subject and frequently confidential to public analysis. In addition, offshore counts on can offer versatility concerning asset management, as trustees can be selected based on competence and administrative advantages. They can likewise be tailored to satisfy certain financial goals, such as estate preparation or tax obligation optimization. Comprehending the lawful and tax obligation effects of offshore trusts is important, as policies vary substantially across various countries. Overall, these trust funds use a critical method to wealth monitoring for those seeking to browse complicated monetary landscapes while delighting in specific advantages that domestic counts on may not provide.

Property Security: Shielding Your Riches

Possession security is an important consideration for individuals seeking to protect their wide range from prospective lawful claims, lenders, or unpredicted monetary setbacks. Offshore trust funds act as a calculated device for accomplishing this objective, providing a layer of protection that domestic possessions might do not have. By transferring possessions into an overseas count on, individuals can create a legal barrier between their wide range and possible complaintants, effectively protecting these assets from lawsuits or insolvency proceedings.The jurisdiction of the overseas depend on usually plays a vital role, as numerous nations offer durable lawful structures that secure count on properties from exterior cases. Additionally, the privacy provided by overseas counts on can better prevent creditors from seeking cases. It is crucial for people to understand the specific regulations governing possession protection in their chosen territory, as this knowledge is basic for making best use of the effectiveness of their riches administration techniques. In general, overseas depends on represent a positive method to maintaining riches versus unforeseeable monetary obstacles.

Tax Obligation Advantages: Browsing the Financial Landscape

Offshore trust funds provide significant tax obligation benefits that can improve wide range monitoring strategies. They supply opportunities for tax obligation deferment, enabling possessions to expand without instant tax ramifications. Additionally, these trusts might use inheritance tax benefits, additionally optimizing the financial heritage for recipients.

Tax Obligation Deferment Opportunities

Exactly how can people utilize offshore depend maximize tax obligation deferral opportunities? Offshore counts on supply a tactical avenue for postponing tax obligations on revenue and resources gains. By putting possessions in an offshore count on, individuals can profit from jurisdictions with desirable tax regimens, permitting potential deferral of tax responsibilities until distributions are made. This system can be particularly useful for high-income earners or financiers with significant funding gains. Furthermore, the revenue generated within the depend on might not go through immediate tax, allowing wealth to expand without the problem of annual tax obligation commitments. Steering through the complexities of international tax obligation regulations, people can successfully utilize overseas depend boost their riches monitoring strategies while decreasing tax obligation exposure.

Inheritance Tax Perks

Personal privacy and Confidentiality: Maintaining Your Matters Discreet

Maintaining personal privacy and discretion is necessary for people seeking to secure their wealth and properties. Offshore depends on provide a durable structure for safeguarding individual information from public examination. By developing such a depend on, individuals can efficiently divide their individual events from their monetary interests, guaranteeing that sensitive information remain undisclosed.The lawful frameworks regulating offshore trust funds commonly supply strong privacy defenses, making it tough for exterior events to accessibility info without permission. This level of discretion is especially interesting high-net-worth individuals worried about possible hazards such as lawsuits or undesirable focus from creditors.Moreover, the discrete nature of overseas jurisdictions boosts privacy, as these areas generally enforce rigorous guidelines surrounding the disclosure of depend on information. People can enjoy the peace of mind that comes with knowing their financial methods are shielded from public knowledge, thereby maintaining their desired degree of discretion in riches monitoring.

Flexibility and Control: Tailoring Your Trust Framework

Offshore counts on supply considerable versatility and control, allowing individuals to customize their count on frameworks to meet certain financial and individual goals. This versatility enables settlors to pick various aspects such as the kind of assets held, distribution terms, and the visit of trustees. By selecting trustees that line up with their purposes and worths, individuals can ensure that their wide range is managed in conformity with their wishes.Additionally, offshore depends on can be structured to fit changing conditions, such as fluctuations in monetary demands or family members dynamics. This suggests that recipients can obtain distributions at specified periods or under certain problems, providing additional modification. The capability to customize depend on provisions also assures that the trust can advance in action to legal or tax obligation adjustments, preserving its performance with time. Eventually, this degree of flexibility encourages people to develop a depend on that aligns perfectly with their long-term wealth management methods.

Prospective Disadvantages: What to Consider

What challenges might individuals deal with when thinking about an offshore depend on for wide range management? While offshore trust funds provide various advantages, they also feature possible downsides that call for careful factor to consider. One significant issue is the price related to developing and keeping such a depend on, which can include legal fees, trustee costs, and ongoing administrative costs. Additionally, people may come across intricate governing requirements that differ by territory, possibly complicating conformity and causing charges if not adhered to properly. Offshore Trust.Moreover, there is an integral risk of currency changes, which can impact the value of the properties kept in the trust. Trust fund beneficiaries might also face challenges in accessing funds because of the administrative processes entailed. Public assumption and potential scrutiny from tax authorities can develop reputational risks. These aspects demand detailed research study and expert support prior to waging an offshore trust fund for riches administration

Secret Considerations Prior To Developing an Offshore Depend On

Before establishing Read Full Article an overseas trust fund, people must consider numerous crucial variables that can substantially affect their wealth monitoring strategy. Legal jurisdiction ramifications can influence the depend on's effectiveness and conformity, while taxes factors to consider may impact overall advantages. A complete understanding of these elements is essential for making informed choices regarding overseas trust funds.

Legal Territory Implications

When taking into consideration the establishment of an offshore trust, the choice of lawful jurisdiction plays an essential duty in shaping the count on's effectiveness and security. Different jurisdictions have differing laws regulating trust funds, consisting of guidelines on asset protection, personal privacy, and compliance with international requirements. A territory with a robust lawful structure can boost the trust's authenticity, while those with less rigorous laws may posture threats. In addition, the reputation of the selected territory can influence the trust's assumption amongst recipients and banks. It is vital to assess elements such as political stability, legal precedents, and the accessibility of experienced fiduciaries. Eventually, selecting the right jurisdiction is vital for accomplishing the preferred purposes of property security and wide range monitoring.

Taxation Considerations and Advantages

Taxes considerations significantly influence the decision to establish an offshore depend on. Such depends on may provide considerable tax obligation advantages, consisting of decreased revenue tax obligation obligation and prospective inheritance tax advantages. In numerous jurisdictions, revenue generated within the count on can be exhausted at lower prices or not in any way if the beneficiaries are non-residents. Additionally, possessions held in an overseas count on may not go through residential estate tax, assisting in wide range preservation. However, it is essential to browse the intricacies of global tax laws to assure conformity and prevent mistakes, such as anti-avoidance regulations. Consequently, people must consult tax obligation specialists experienced in offshore frameworks to maximize benefits while sticking to relevant legislations and regulations.

Often Asked Inquiries

How Do I Pick the Right Jurisdiction for My Offshore Depend on?

Choosing the best jurisdiction for an offshore count on entails assessing variables such as lawful security, tax ramifications, governing environment, and privacy laws. Each territory supplies distinct advantages that can greatly impact wide range administration approaches.

Can I Change the Recipients of My Offshore Trust Later?

The basics capability to transform recipients of an overseas count on relies on the count on's terms and jurisdictional legislations. Normally, lots of overseas counts on allow modifications, yet it is necessary to consult legal recommendations to guarantee compliance.

What Is the Minimum Quantity Needed to Develop an Offshore Trust?

The minimum amount needed to develop an overseas count on differs significantly by territory and copyright. Typically, it ranges from $100,000 to $1 million, depending on the intricacy of the trust and connected costs.

Are There Any Legal Restrictions on Offshore Trust Investments?

The lawful restrictions on offshore trust investments vary by territory. Generally, regulations may restrict particular property kinds, impose coverage requirements, or limit purchases with details nations, making certain compliance with international laws and anti-money laundering actions.

Just how Do I Liquify an Offshore Trust Fund if Needed?

To liquify an overseas count on, one should comply with the terms detailed in the trust deed, assuring compliance with applicable legislations. Lawful guidance is often suggested to browse prospective complexities and determine all responsibilities are satisfied. By moving assets right into an offshore trust fund, people can create a lawful barrier between their wide range and potential complaintants, properly protecting these assets from legal actions or insolvency proceedings.The territory of the overseas depend on typically plays an important duty, as several countries use durable legal frameworks that secure count on properties from outside cases. By establishing such a trust fund, individuals can properly divide their personal events from their economic interests, ensuring that sensitive information stay undisclosed.The lawful frameworks regulating overseas trusts usually offer strong personal privacy defenses, making it tough for exterior parties to accessibility information without approval. Offshore trusts give considerable versatility and try this out control, permitting individuals to customize their trust fund structures to fulfill particular monetary and individual objectives. When considering the establishment of an overseas count on, the choice of lawful jurisdiction plays an essential duty in forming the count on's effectiveness and safety. The capacity to alter recipients of an offshore count on depends on the trust's terms and jurisdictional laws.

Report this page